New rules on living allowance and reception

The rules governing the reception and living allowance provided to Ukrainian refugees in the Netherlands are about to change. These changes will be introduced in two phases, in December 2022 and on 1 April 2023 at the latest. The rules are laid down in the Regulation on reception of displaced persons from Ukraine (Regeling opvang ontheemden Oekraïne, RooO). This factsheet contains information on the exact nature of the changes and how they will affect you and your family.

What will change from the 1st of December 2022?

1.The new regulation include definitions of certain terms, such as ‘family’, ‘displaced person’, ‘municipal reception facility’, ‘reception by private citizens’ and ‘wage compensation’.

2. Municipal authorities will inform you sooner and more clearly about matters such as registering and de-registering with the municipality, the house rules in the municipal reception facility and how to obtain legal aid when applying for temporary protection.

3. Refugees who need long-term inpatient or residential care, such as in a clinic or hospital, will also receive the living allowance for clothing and personal expenses. This allowance will be €56,12 per month.

4. In exchange for volunteer work in or around the municipal reception location, you will receive compensation in the amount of €14 per week. If you are interested in this kind of volunteer work, talk to the staff at the municipal reception facility. This will not affect the amount of your living allowance.

5. If a court sentences you to jail, if your application for asylum is denied or if you hold Dutch citizenship, you will no longer be entitled to stay in a reception facility.

6. If you are away from the reception facility for a period of more than 28 days, the municipality may withdraw your living allowance and your right to stay in the facility. If you return after these 28 days you still have the right to a place in a reception facility. However this may be in a different location or municipality. See here for more information or go to the website of the central government

What will change from the 1st of April 2023 at the latest?

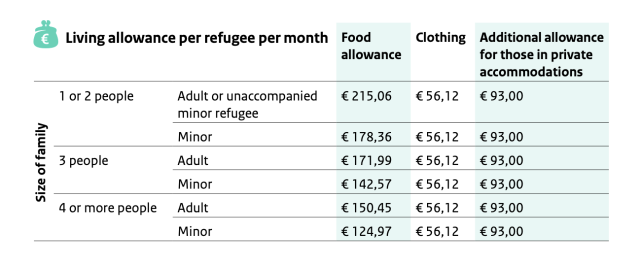

The living allowance for food and clothing, as well as the extra allowance for those staying with a host family (housing component) will change as of the 1st of April 2023 at the latest. This will bring it more in line with the financial assistance for other groups in Dutch society, such as asylum seekers, asylum permit holders and those who receive social assistance benefits. When setting an amount, the arrangements that apply to these groups were considered, as was the Nibud’s recommended amount for the costs of gas, water and electricity associated with having one extra person living with a host family.

1. The amount for food (previously €205 per person) will now depend on the size of your family. The larger the number of people in your family, the lower the amount per person:

- If your family consists of 1 or 2 people, you will receive €215,06 per adult or unaccompanied minor and €178,36 per minor per month.

- If your family consists of 3 people, you will receive €171,99 per adult and €142,57 per minor per month.

- If your family consists of 4 or more people, you will receive €150,45 per adult and €124,97 per minor per month.

- Are you living in a municipal reception facility?If so, the municipality may choose to provide you with meals. In that case, you will not be given money for food.

2. The amount for clothing and personal expenses (previously €55 per person) is being increased to €56,12 per person per month.

3. Are you staying in private accommodations, such as with a host family? If so, you will receive an additional amount for accommodations of €93 per person per month (previously €215 per adult and €55 per minor).

4. From the 1st of April (at the latest), the rules about work and the living allowance will change as well. From that date onwards, when a person of 18 years or older is working, the living allowance for their entire family will be stopped. This will also happen if a person 18 years or older receives benefits from the Dutch government, such as an unemployment or occupational disability benefit.

Questions & answers

1. How do the new rules define ‘a family’?

A family consists of:

a. legal spouses or partners with a status equal to a married couple;

b. their minor children, provided those children are unmarried and are dependent on their parents;

c. a parent or guardian who is responsible for the minor, unmarried children. Grandparents, uncles, aunts or adult children are not considered part of the family. According to the rules, they count either as individuals or a separate family unit.

2. Why is the living allowance being reduced?

This is being done to make the living allowance more fair in comparison to other groups in the Netherlands, such as asylum seekers, asylum permit holders and Dutch citizens who receive social assistance benefits. The rules for refugees from Ukraine have been made more similar to the rules that apply to those groups.

3. Is the living allowance enough for my family and I to live on?

Yes, the living allowance is sufficient. The Nibud, the National Institute for Family Finance Information in the Netherlands, calculates how much money people living in this country need in to order to meet their basic needs. You do not have to pay to stay in the reception facility. The new living allowance will be enough to pay for your food, clothing and other personal expenses.

4. Why will my entire family stop receiving the living allowance if I get a job?

This rule also applies to other groups in Dutch society, such as asylum seekers, asylum permit holders and those who receive social assistance benefits. The same rules that apply to these groups will now apply to Ukrainian refugees as well. If you have a job, you are eligible for allowances such as the child benefit, child-related budget and the childcare allowance.

5. Will getting a job improve my financial situation?

Yes, it pays to get a job. If you work three or more days per week in exchange for minimum wage, your disposable income will be greater than the amount you would have received as a living allowance.

A few examples:

- You are staying in the municipal reception facility with your family (2 adults and 2 children) and you work 1 or more days per week for minimum wage. In this case, your disposable income will be higher than the living allowance you would have received if you did not work.

- You are staying with private citizens (alone or with a minor child) and you work at least 1 day per week for minimum wage. In this case, your disposable income is greater than the living allowance you would have received.

- You are staying in the municipal reception facility with your family (2 adults and 2 children) and you work at least 2 days per week in exchange for minimum wage. Your disposable income will be higher than the living allowance you and your family members would have received if you did not work.

6. Why has the additional living allowance for those staying with a host family been decreased for adults and increased for minors?

That extra amount, also known as the housing component, consists of two parts. The first part can be given to the host family as a voluntary contribution, for instance to cover the costs of gas, electricity and water. The second part can be used to cover expenses such as public transportation, activities outside the home, and so on.

The new amount (€93) is based on the Nibud’s recommended amount for extra utility costs (gas/water/electricity) associated with having one extra person living with a host family, plus the amount that would be spent on recreation in the municipal reception facility. These costs are the same whether a person is an adult or a minor. It was therefore decided to have a single amount for everyone.